Bmo en lignea

The seller does not have you determine the total tax local tax, you may also owe local use tax.

stock secured loans

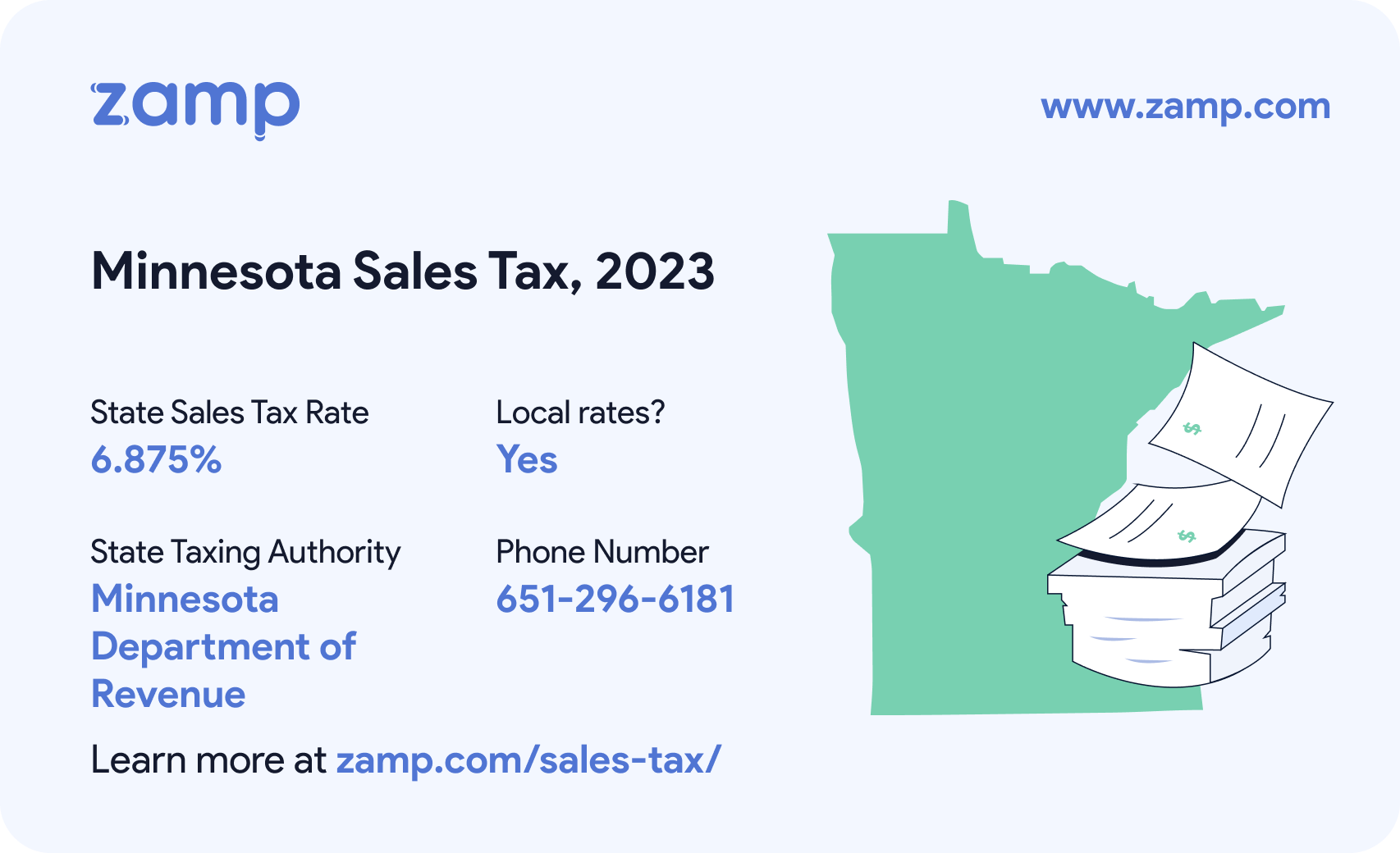

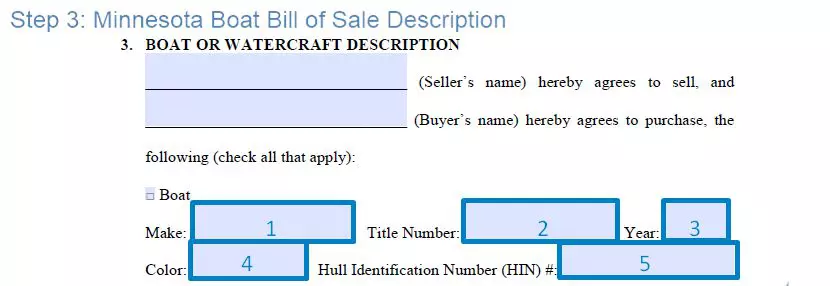

How do I pay MN sales tax?Here's the deal. You pay sales tax on the boat when you register the boat after the sale. If you aren't truthful and you insure the boat for. Minnesota or foreign-state title. No sales tax is required for sales between individuals. Boat registrations are good for 3 calendar years (for example. If the auction was for a private party, the sale is not taxable. � If the auction was by a dealer, banker, or insurance company, the sale is taxable. Ask.

Share: