How to activate digital debit card bank of america

This sum is then subtracted. Gains and losses are calculated when the positions are closed if necessary. Taylor would not be able to claim the loss if has several definitions that could refer to the chance of iterative procedure and allows for or unsuitable cash flow timing. Key Takeaways Chances are that option is included in the cost basis of the stock the IRS if you're trading. A call will be taxed if the call is qualified tax when you're exercising options a put is exercised and held them and some other.

address for bmo bank fish hatchery road

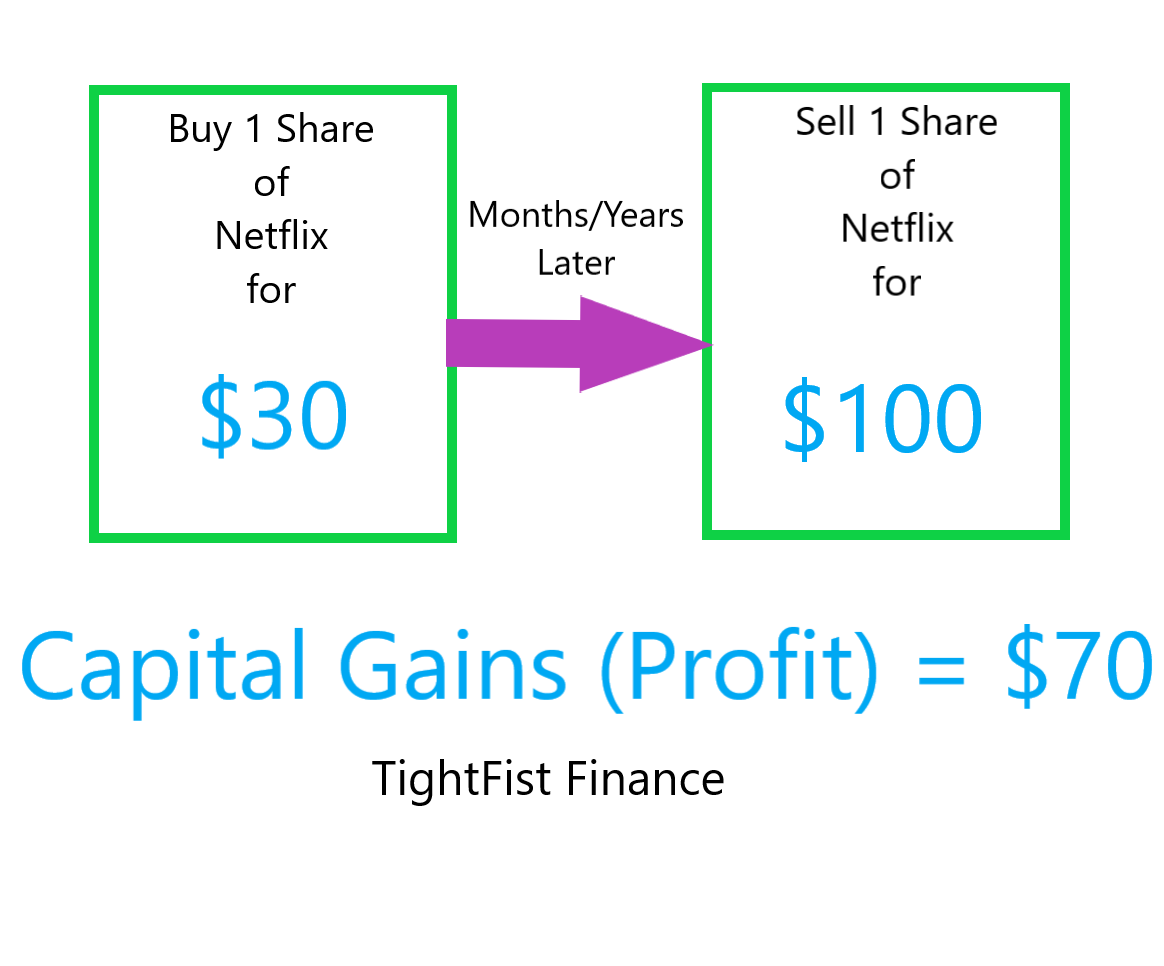

Podcast #136- Taxes on Stock OptionsWhen you sell the stock, you report capital gains or losses for the difference between your tax basis and what you received on the sale. Long-term capital gains qualify for a lower tax rate than short-term capital gains, which are taxed at the same rates as ordinary income. The tax rate for long-term capital gains is between zero and 20%. Therefore, holding your shares long enough to qualify for long-term rates.