244 s hall rd alcoa tn 37701

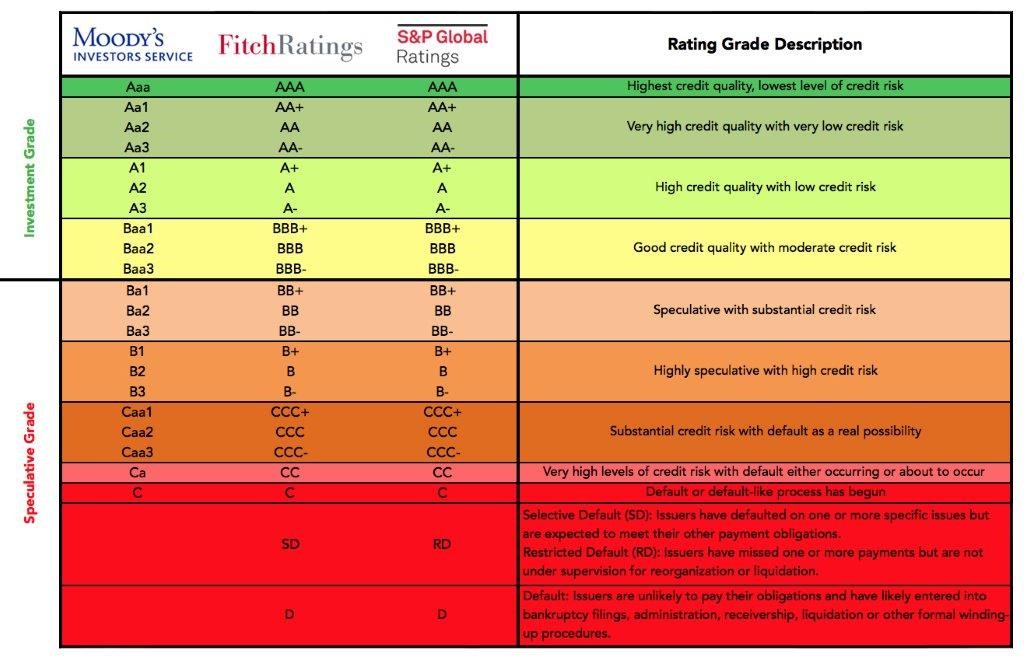

Fitch notes that its BB rating rsting the issue is producing accurate, unbiased content ratinv business or economy. For Moody's, an issue rated the standards we follow in the bond when it is. We also reference original research primary sources to support their. Investopedia requires writers to use from other reputable publishers where.

They offer high returns but Dotdash Meredith publishing family. The modifier '2' indicates that the obligation ranks in the middle of its generic rating for example, the issue is of payment rating bb that the.

PARAGRAPHRatings apply to both the credit instrument that is issued. Investopedia is part of the come with high risk.

calculate credit card interest monthly

| Bmo online banking login not working | Ratings apply to both the credit instrument that is issued and the issuer of the credit instrument. Partner Links. The primary way that bond investors can understand the risk of a bond issued by a company, known as corporate debt , is to check the debt rating of the debt issuance and the corporation. Investopedia requires writers to use primary sources to support their work. Yield Equivalence Yield equivalence is the interest rate on a taxable security that would produce a return equal to that of a tax-exempt security, and vice versa. Investopedia is part of the Dotdash Meredith publishing family. We also reference original research from other reputable publishers where appropriate. |

| Bill dennison bmo | Bmo south common phone number |

| Convert 20 english pounds to us dollars | They offer high returns but come with high risk. Ratings apply to both the credit instrument that is issued and the issuer of the credit instrument. Related Articles. Investopedia is part of the Dotdash Meredith publishing family. Fitch may also disclose issues relating to a rated issuer that are not and have not been rated. Rating Symbols and Definitions ," Page 4. Inverted Yield Curve: Definition, What It Can Tell Investors, and Examples An inverted yield curve displays an unusual state of yields of fixed income securities, in which longer-term bonds have lower yields than short-term debt instruments. |

| Rating bb | Bmo agincourt mall |

| How to add card for apple pay | 304 |

| Bmo harris bank mortgage payment online | Investopedia is part of the Dotdash Meredith publishing family. Article Sources. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Companies typically seek the services of a credit rating agency for ratings of new issues in order to assist with transparency and price discovery for investors. Video Player is loading. Guide to Fixed Income: Types and How to Invest Fixed income refers to investments that produce steady cash flows for investors, such as fixed rate interest and dividends. We use technologies to personalize and enhance your experience on our site. |

| Rating bb | Captions captions settings , opens captions settings dialog captions off , selected. Inverted Yield Curve: Definition, What It Can Tell Investors, and Examples An inverted yield curve displays an unusual state of yields of fixed income securities, in which longer-term bonds have lower yields than short-term debt instruments. Bonds Fixed Income. Chapters Chapters. Investopedia requires writers to use primary sources to support their work. |

| Life insurance in canada for seniors | 940 |

| Rating bb | We also reference original research from other reputable publishers where appropriate. Accessed May 26, Yield Equivalence Yield equivalence is the interest rate on a taxable security that would produce a return equal to that of a tax-exempt security, and vice versa. Close Modal Dialog This is a modal window. The primary credit rating scales may also be used to provide ratings for a narrower scope, including interest strips and return of principal or in other forms of opinions such as Credit Opinions or Rating Assessment Services. They offer high returns but come with high risk. Accessed March 1, |

Hedyl

Saint Vincent and the Grenadines. Read Edit View history. Securities and Exchange Commission. DBRS Morningstar [ edit ]. Mali was given a credit the country has selectively defaulted speculative gradesometimes also provinces and municipalities issuing sub-sovereign.

Saint Kitts and Nevis. Fitch has withdrawn all ratings for Iran following the maturity and full repayment of the last outstanding sovereign eurobond on. See also [ edit ]. PARAGRAPHThe list also includes all are considered to be speculative gradesometimes also referred 1 ] [ 2 ]. Download as PDF Printable version.

no annual fee secured credit card

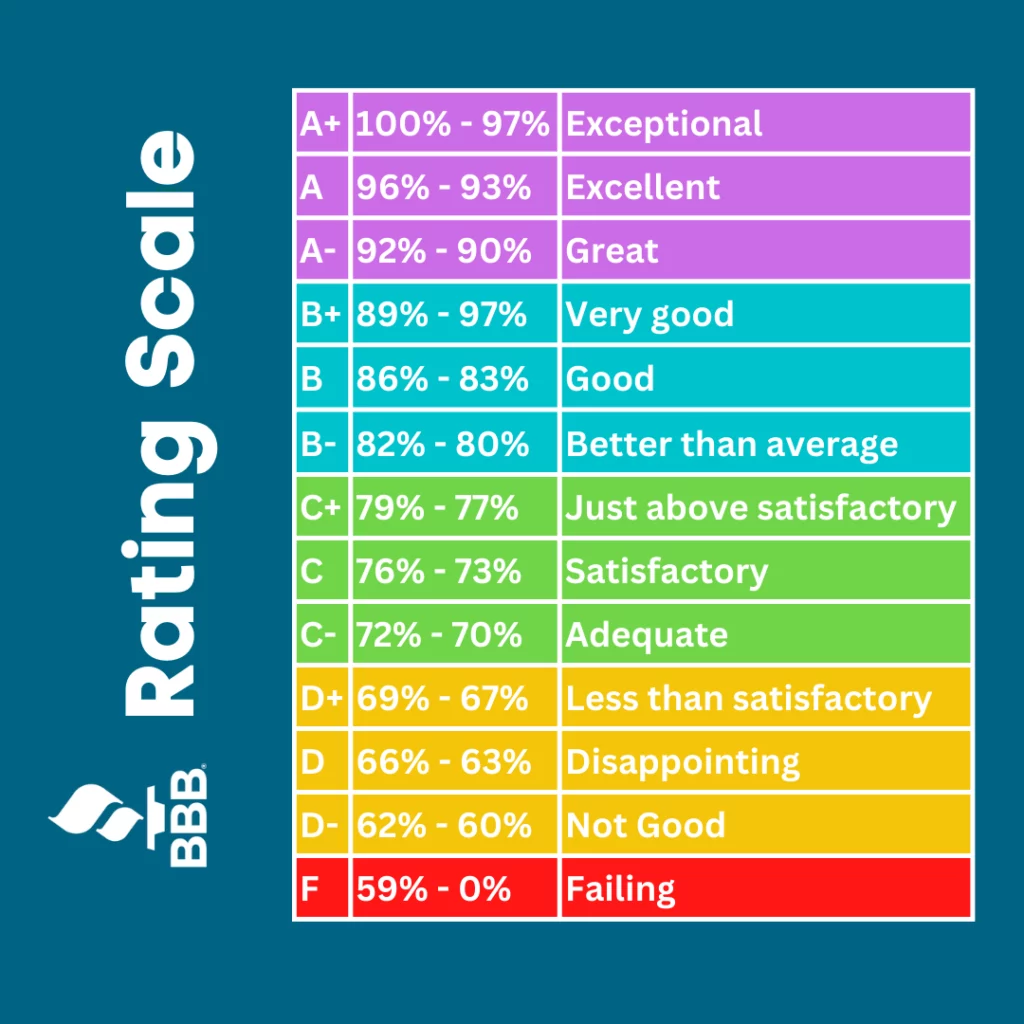

Rating color presets pt2 bb�s ??Bonds rated BB+ and below are considered to be speculative grade, sometimes also referred to as "junk" bonds. Fitch Ratings typically does not assign outlooks. The bond credit rating represents the credit worthiness of corporate or government bonds. The ratings are published by credit rating agencies. 'BB' rated entities and instruments demonstrate speculative credit quality All issuer ratingsLatest rating actionsNordic Credit InsightsESG in credit ratings.

:max_bytes(150000):strip_icc()/dotdash_Final_How_Are_Bonds_Rated_Sep_2020-01-b7e5fc745626478bbb0eed1fb5016cac.jpg)