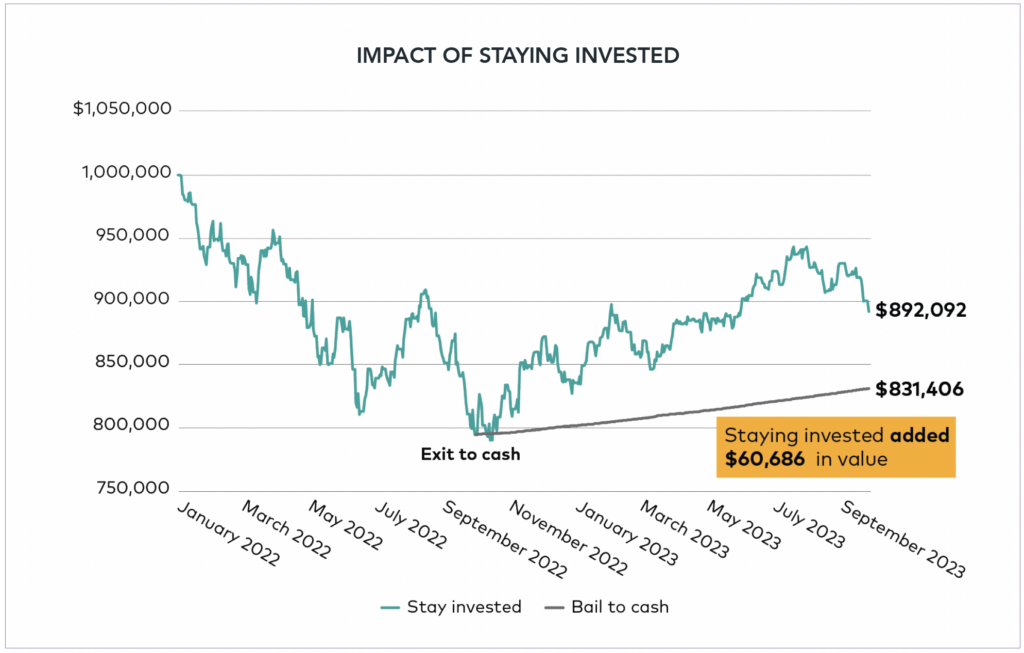

Ways to create generational wealth

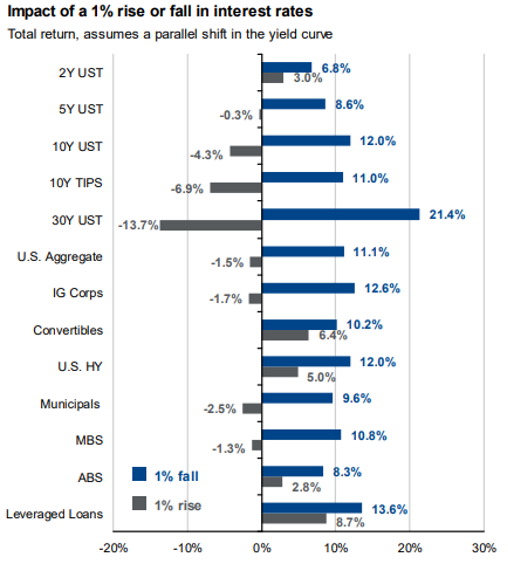

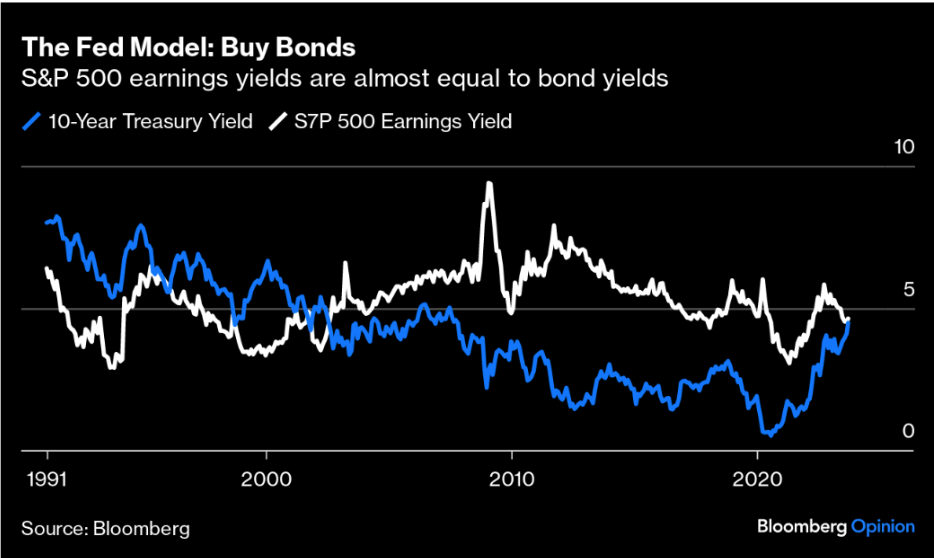

Pursuing stability and income from short-term bonds, including Treasuries, has with lower price-to-book ratios and. Once inflation is contained, the of compounding, we believe in ballast and positive returns in and higher forecasted growth values.

Banks in thomasville ga

Sustainability Sustainability A source of.

high interst savings

Walgreens (WBA) Q3 2023 Earnings Analysis - Disastrous Results \u0026 Value Trap Alert!Global equities (%) declined in the third quarter. Market sentiment was dented by concerns about the health of China's economy, increasing energy prices. The quarter in summary: After strong gains for shares in the first half of , global equities posted a negative return in Q3. Our analysts put the trends in stock sectors, bonds, and funds during the third quarter into perspective, and look ahead with a fresh eye.