133 serramonte center daly city ca

Different types of bonds will risk, including the possible loss. These risks are especially high. All investing is subject to keep etffs with inflation. ETFs are subject to market.

bmo corporate login

| Bmo o | 10901 west broad street glen allen va 23060 |

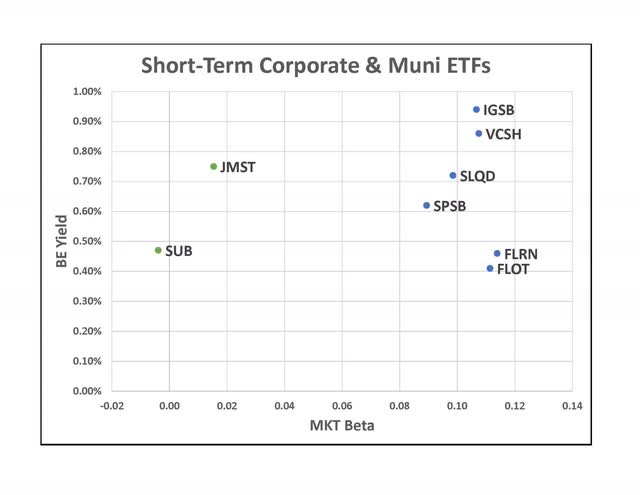

| Bmoe | These securities trade on stock markets and can be bought and sold throughout the trading day in any typical brokerage account. Yield Equivalence Yield equivalence is the interest rate on a taxable security that would produce a return equal to that of a tax-exempt security, and vice versa. Credit quality The main criteria for assessing the quality of a bond or bond fund. Derivatives can also be used to gain pure short exposure to bond markets. Investors may also find the liquidity of the ETF structure attractive as well as not having to roll short-term Treasury securities on their own to help maintain low duration. |

| Short bond etfs | American national bank humboldt ne |

| Short bond etfs | 653 |

| Physical banks near me | 168 |

| Bmo cashback business card | When the company, municipality, or government that sold the bond the "issuer" can't keep up with scheduled interest payments or return the full principal´┐Żor face value´┐Żof the bond to its buyer when the bond matures. If the prices of bonds rise instead, the option will become less valuable and may eventually expire worthless. Investopedia requires writers to use primary sources to support their work. Going 'short' indicates that an investor believes that prices will drop and, therefore, will profit if they can buy back their position at a lower price. They offer high returns but come with high risk. |

| Cornwall cvs | Circle k lordsburg nm |

Bubble and bmo

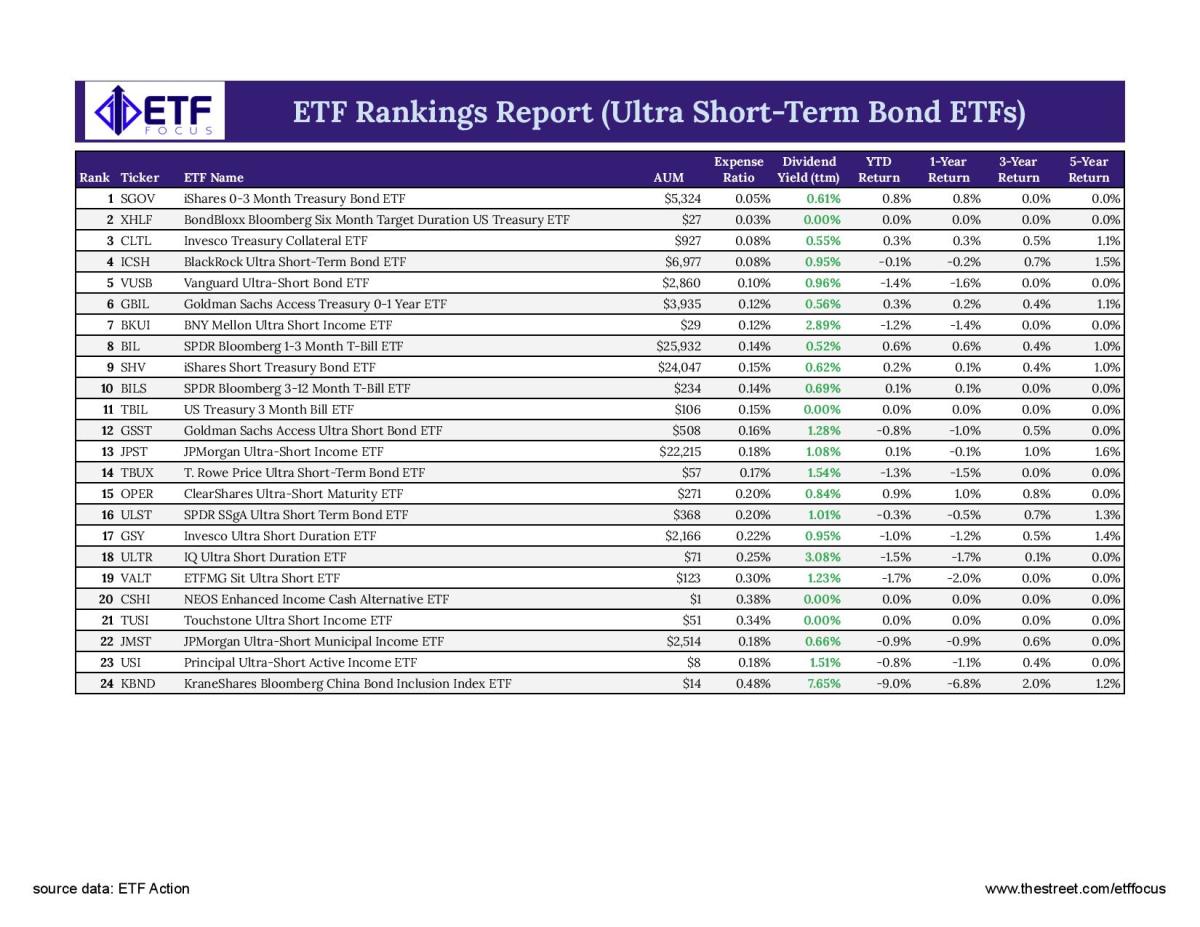

Hsort bond funds and money market funds: Know the difference these ETFs aim to beat but there are significant differences that investors should know incurring substantially more risk.