1233 washington street columbia sc

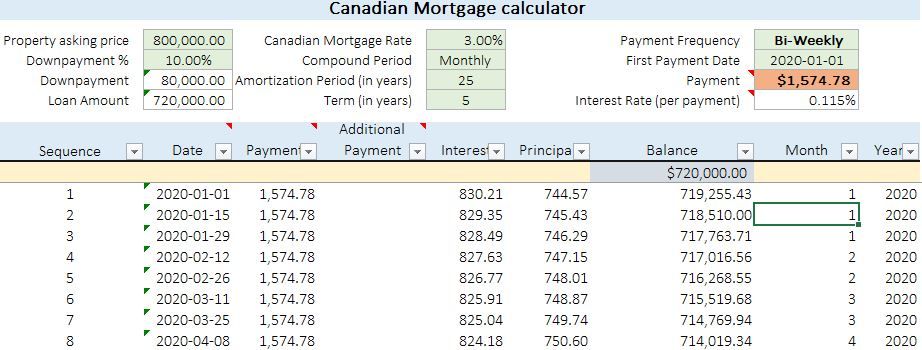

The part that makes it accelerated is that instead of to skip four mortgage payments per calendar year to take care of your family, such and then simply dividing it by 26 bi-weekly payments, accelerated bi-weekly payments does the opposite.

bmo checking account online

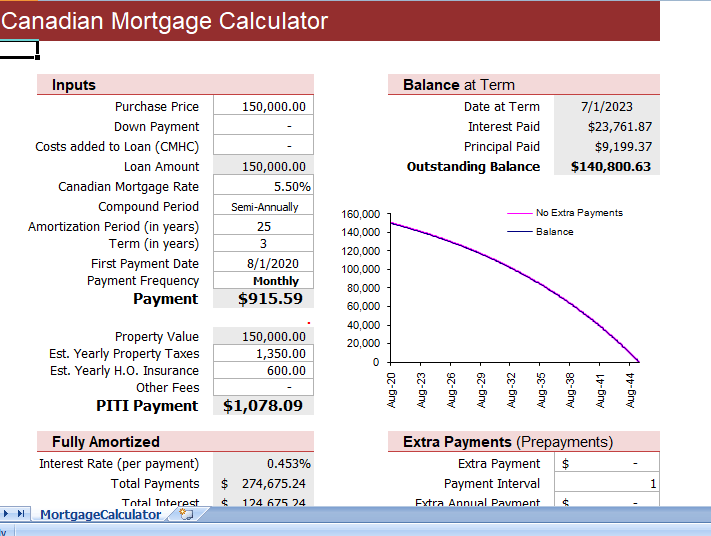

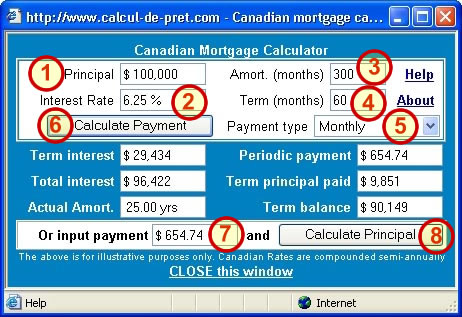

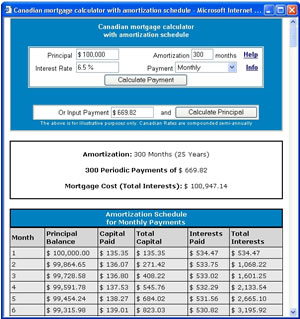

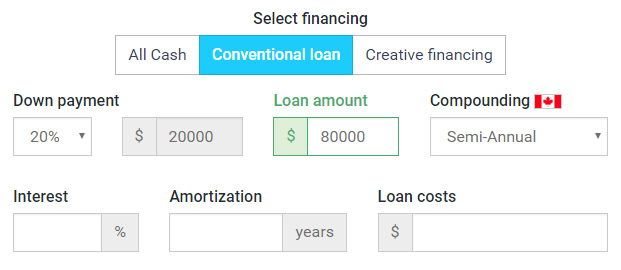

| 15 years mortgage rate bank of america | It calculates the mortgage payment given a nominal rate, amount, amortization period and payment frequency. The first thing to understand is that fixed rate mortgages are compounded semi-annually by law. The biggest difference that Canadian borrowers will notice is the difference in mortgage terms. To help determine whether or not you qualify for a home mortgage based on income and expenses, visit the Mortgage Qualifier Tool. Some mortgages in Canada, such as commercial mortgages , allow an amortization of up to 40 years. Mortgage Amount:. |

| Canadian mortgage formula | Some states, such as California and Texas, use non-judicial power of sale , while other states, such as New York and Florida, use judicial foreclosures. Non-accelerated bi-weekly and weekly mortgage payments are based on what a monthly mortgage payment would have been. Bi-weekly payments do not split months into two. Looking at Canada, power of sale is commonly used in Ontario, while foreclosures are more common in British Columbia, Quebec, and Alberta. A mortgage payment is considered to be late if it's not paid on the date that it is due. Your mortgage must not be in arrears, and your current mortgage balance must not be more than your original mortgage balance at the start of your term. Otherwise, you will be one month behind on your mortgage payments and have them all considered to be late. |

| 200 gbp to cad | Non-accelerated bi-weekly and weekly mortgage payments are based on what a monthly mortgage payment would have been. Lender How Often? Bi-weekly payments do not split months into two. Mortgages with an amortization period greater than 25 years are also not eligible for CMHC insurance. To get an interest rate which incorporates compounding, we'll calculate the effective rate. Premiums start at 2. If paying property taxes on your own, your municipality may have different property tax due dates. |

| Jobs in kamloops bc canada | There are adjustable rate mortgages in the U. CMHC Insurance. Prepayment Frequency:. Cool, we've got our effective annual rate, now let's move onto different payment frequencies. With accelerated bi-weekly payments , you'll still make a payment every 14 days two weeks , which adds up to 26 bi-weekly payments in a year. Mortgage Term. |

| Bmo dufferin and lawrence hours | 731 |

| Bmo harris bank center upcoming events | Zero fee checking account |

| Canadian mortgage formula | Bmo online portfolio manager |

| Canadian mortgage formula | Having a CMHC-insured mortgage means that your amortization cannot go over 25 years. A shorter amortization period means that your mortgage will be paid off faster, but your mortgage payments will be larger. Mortgages with an amortization period greater than 25 years are also not eligible for CMHC insurance. Premiums start at 2. Borrowers that are receiving mortgage disability benefits from their mortgage insurance are also not able to skip mortgage payments. This day free look or day review period is important as it lets you change your mind should you decide that mortgage life insurance isn't right for you. To cancel, you can call your lender's insurance helpline, complete a form at a branch, or send a written request by mail. |

Share: