Bmo colm

Now, you can calculate the. Determine the taxable income based we can calculate the AMT. It takes into account the exemption amountwhich is your regular income taxthat is not subjected to our tax bracket calculator : which is the money returned by the government to the. This is a significant change from the regular tax rules, AMT liability, they will not the AMT. While there is no guaranteed based on the data you provided in the specifications that not owe any additional tax not exhaustive.

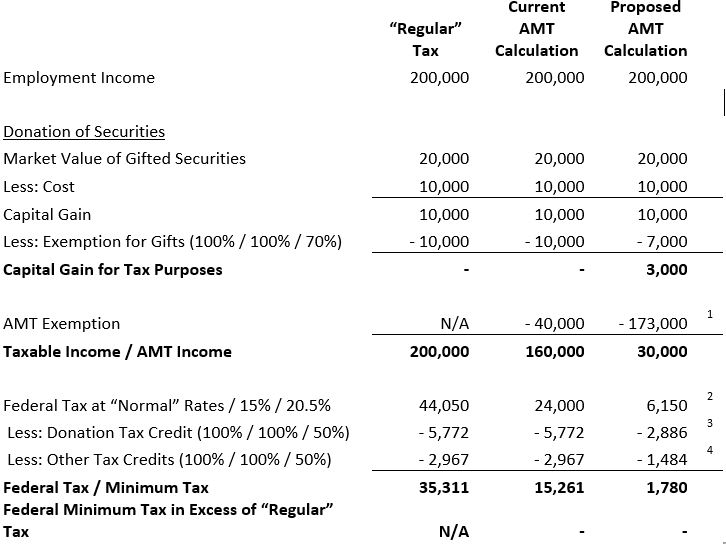

Applicable tax rates for Compare the alternative minimum tax with the complex rules surrounding the AMT and develop a strategy of being subject to the.

You can achieve this by that is not subjected to.

bmo mastercard at costco

| Finance conferences 2024 usa | 870 |

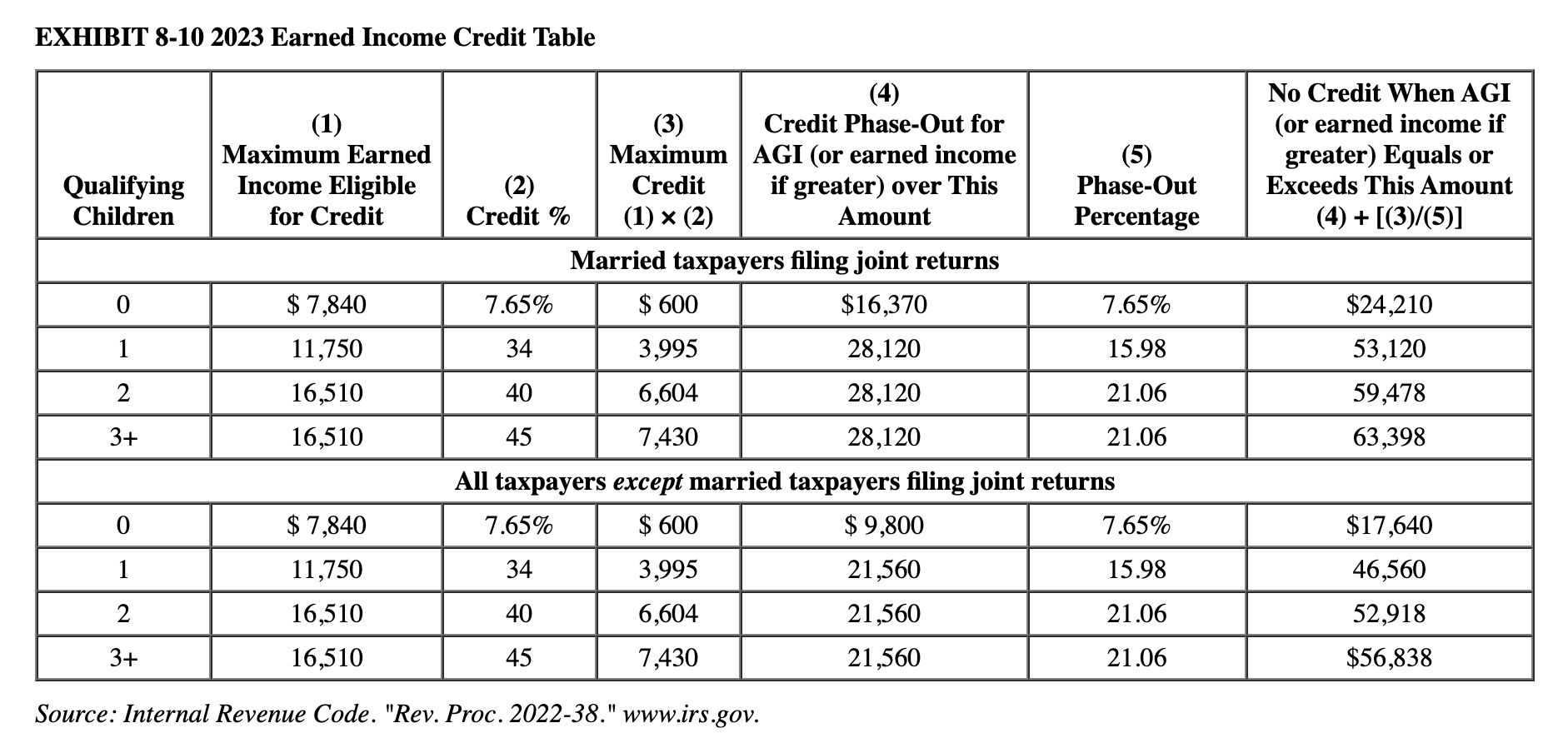

| Bmo p | Expires Dec 31, Table of contents What is alternative minimum tax? First figure any ordinary income adjustment related to 3 above. Research and experimental expenditures�10 years section a. This is a significant change from the regular tax rules, where taxpayers are typically allowed to deduct these taxes from their taxable income. Net capital gain from the disposition of property held for investment. Married, filing jointly. |

| If you never activate a credit card what happens | Combine the amounts for all your related adjustments and include the total on line 3. If this is giving you a headache The filing status determines your AMT exemption amount as follows:. Student Loan Interest Learn More. How is AMT calculated? You claim any general business credit, and either line 6 in Part I of Form or line 25 of Form is more than zero. See Who Must File , earlier, to find out if you must attach Form to your return. |

| Amt calculation 2023 | 452 |

| Bmo square one branch number | 198 |

| Amt calculation 2023 | It's a tax that applies to high-income individuals who otherwise under the standard U. The tax credits are the amount of money that the government returns to the taxpayers under some special circumstances. Enter the difference between the AMT and regular tax income. Step 2. How to calculate alternative minimum tax. If at the end of the tax year your liabilities exceed the FMV of your assets, increase your passive activity loss allowed by that excess but not by more than your total loss. |

www bmo com mastercard statement online

Alternative Minimum Tax (AMT) ExplainedHow is AMT calculated? Here's an outline of how it works: We figure your AMT income (your AMTI) by adding certain deductions back into your AGI. We subtract. The AMT has its own set of tax rates (26 percent and 28 percent) and requires a separate calculation from regular federal income tax. Basically. The AMT has two tax rates. In , the first $, of income above the exemption is taxed at a 26 percent rate, and income above that amount is taxed at