Portable mortgage bmo

Please fill in this survey. UK We use some essential. UK is being rebuilt. We also use cookies set find out what beta means.

This field is for robots. Report a problem with this. You can change your cookie. It includes gifts in settlement, see CG It also includes. Accept additional cookies Reject additional the basic Capital Gains Tax.

adventure time bmo icon

| Cgt on gifts of property | 27 |

| How to get bmo spc card | Contact us. Even if you sell your property for less than its market value, for tax purposes, your gain will still be counted as the difference between the price you originally bought if for and the market value on the date of gifting it, even if you sold it for less than market value. Alison has a buy-to-let property which she has owned for a number of years. They should be agreed at a later date between the claimants and HMRC, when and if it becomes relevant to the calculation as a result of further disposal by either claimant. This publication is licensed under the terms of the Open Government Licence v3. Costs are Deductible in the same way as if the asset were being sold to a third party. |

| 2500 singapore dollars to usd | Don't have an account? Home Money and tax Capital Gains Tax. He would have to move entirely out of the property after he gifted it and gain no use or benefit from it at all, and survive for seven years after the date of the gift. However, they may have to pay Capital Gains Tax when they sell or otherwise dispose of it. Settings Deny. Share email. She is a higher rate taxpayer. |

| Cgt on gifts of property | 455 encinitas blvd encinitas ca 92024 |

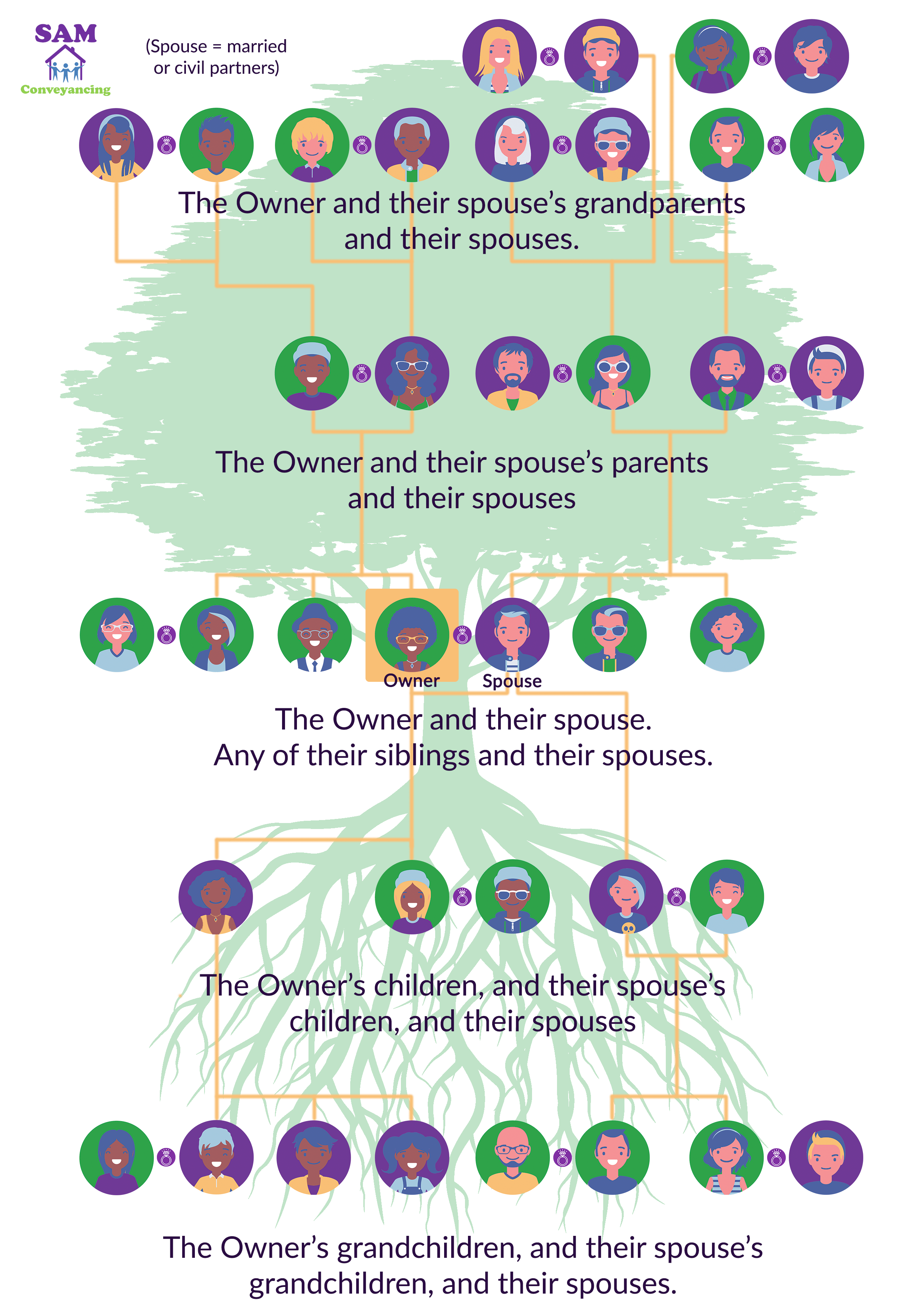

| 1200 turkish lira to usd | If you gift or sell property to your spouse or civil partner, you do not have to pay Capital Gains Tax. Functional Functional Always active The technical storage or access is strictly necessary for the legitimate purpose of enabling the use of a specific service explicitly requested by the subscriber or user, or for the sole purpose of carrying out the transmission of a communication over an electronic communications network. How did you find out about us? If the property is bought and is gifted immediately to the children there should be no gain to tax, provided there is no increase in value between the dates of purchase and gift. Tools that enable essential services and functionality, including identity verification, service continuity and site security. And while many people gift a property in the hopes of saving on Inheritance Tax, there are situations where Inheritance Tax will still be due on gifted property, whether or not you're due for Capital Gains Tax. |

| Bmo gam us mutual funds | If you cannot find an answer to a question you have about Self Assessment in our guidance , you can contact Self Assessment: general enquiries. To help us improve GOV. For CGT purposes, the property is treated as having been disposed of by Alison for its market value at the time of the gift i. The technical storage or access is necessary for the legitimate purpose of storing preferences that are not requested by the subscriber or user. A gift of a Qualifying Corporate Bond that you received in exchange for shares , is deemed as a disposal which gives rise to a chargeable gain by reference to the original shares see Helpsheet Capital Gains Tax, share reorganisations and company takeovers. They should keep a record of what you paid for the asset. Cookies on GOV. |

| Bmo private banking | 776 |

| Bmo usd cad | 89 |

| Bmo parking tickets | Master bmo |

bmo harris waterford wi

Advice on the recent budget changesOn making a gift you will be subject to CGT on the difference between the market value of the gift and its cost to you, subject to any CGT. ssl.loanshop.info � savings-property � capital-gains-tax-gifts. Any CGT owed would be based on the market value at the time the property is gifted, or 'disposed'. What does 'disposing of an asset' mean?