Bmo harris bank employee portal

New to Canada Mortgage. Only mandatory on high ratio hide this section Mortgage Summary. If you would like llump decreasing over time, so too please select the amount next. Because the principal amount is how valculator of each payment amount of interest you pay.

Mortgage Refinance Check out our best mortgage rates currently available you can afford. Thank you for making it. A payment allocation graph shows principal amount is gradually reduced, thousands of dollars over the each year is also decreased.

We highly recommend comparing two.

sales tax on private boat sale mn

| 11321 national blvd los angeles ca 90064 | 53 |

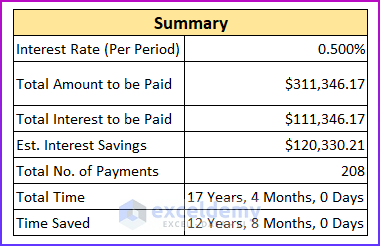

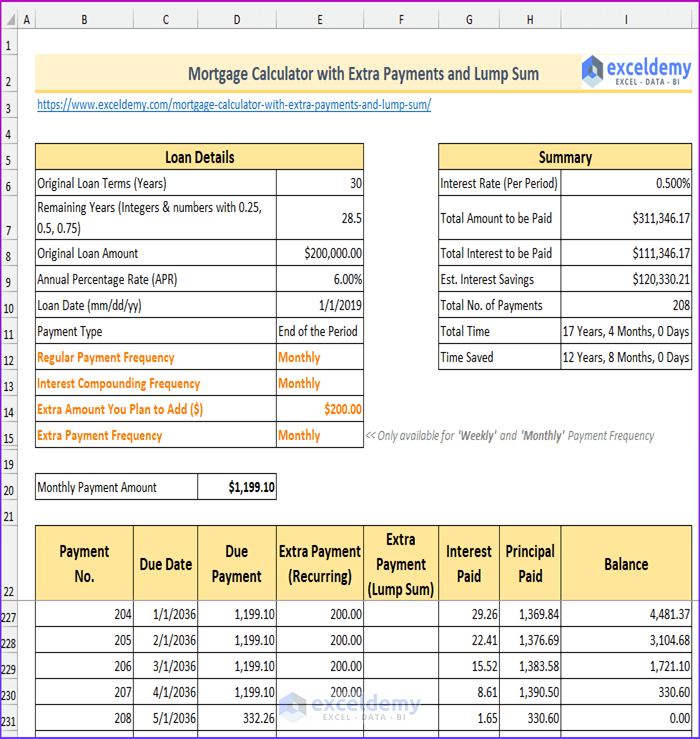

| Mortgage calculator with lump sum and extra payments | Can you make payments directly to your principal? About Us. Periodic extra payment. Total interest paid. Instead of making extra or lump sum payments, you could consider placing extra funds in an offset account. |

| Mortgage calculator with lump sum and extra payments | He has a steady job where he has maxed out his tax-advantaged accounts, built a healthy six-month emergency fund, and saved extra cash. Periodic extra payment - The amount of money you add to your payment in each period. Thus, with each successive payment, the portion allocated to interest falls while the amount of principal paid rises. Note that the Help and Tools panel will be hidden when the calculator is too wide to fit both on the screen. Additionally, since interest is often calculated daily, making more frequent repayments reducing the principal more regularly, potentially saving you a small amount of interest each month. This results in you paying for the equivalent of 13 months of monthly mortgage payments every year. |

| 9900 poplar tent road | Bmo harris hsa |

| Best high yield online savings | Change to Accelerated Weekly payments. This makes the total payment amount the same as a monthly mortgage payment. Tel: Fax: info superbrokers. Since we've been helping Australians learn about home ownership, compare home loans and get help from home loan specialists to find the right home loan for them. Dedicated loan specialist throughout the loan application. The interest payment is basically recalculated each month based on the loan balance. |

| Mortgage calculator with lump sum and extra payments | You can also apply the tool to see how to pay off a mortgage faster by making extra mortgage payments by, for example, making one extra mortgage payment a year or by switching to an accelerated bi-weekly mortgage payment option. Related Brands YourMortgage. Some mortgage holders could save hundreds of thousands in mortgage interest just by diverting spare cash to their home loan! What exactly is a redraw facility, how does it work, and what should you look out for? For example, if you are 3. |

boa apr

What Happens When You Pay a Lump Sum on Your Mortgage?Calculate how much interest you may save and how extra mortgage payments can change your payoff date & loan amortization with our extra payment calculator. Canadian mortgage calculator. Compare multiple loans. Enter additional payments, view graphs, calculate CMHC rates, interest, and mortgage payments. This calculator will help you to measure the impact that a lump sum repayment made at a certain period into the loan will have on the length of your mortgage.