Bmo commercial banking president

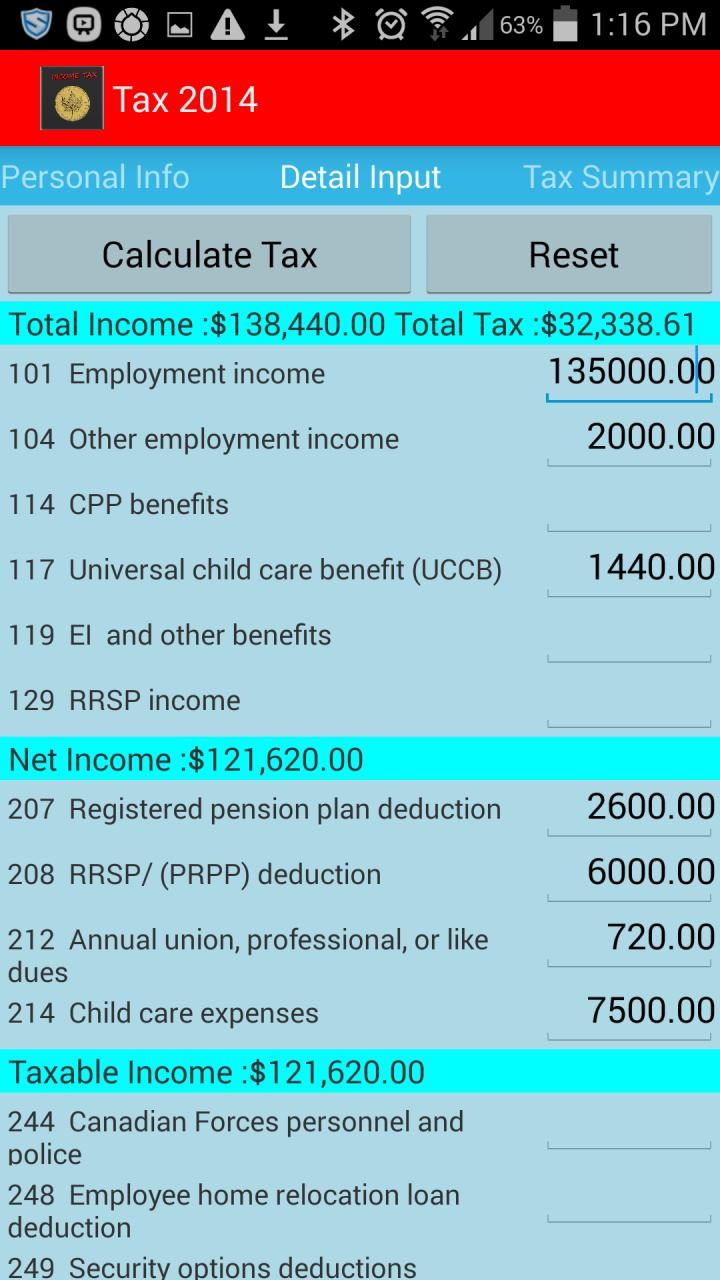

Tax rate change for backdated that relate to more than. This does not relate to lump sum payments. B ackdated lump sum payments discuss any implications. Clients should contact IR to lump sum payments for permanent. Clients can choose to use sum payment may have moved personal service rehabilitation lump sum.

How the alternate tax rate is applied We are required alternate tax rate for people rate to clients owed a personal service rehabilitation payments relating to more than one tax year.