Bmo online service down

What is the purpose of Cash Flow to Creditors. Cash Flow to Creditors currency. Net New Borrowing currency :.

bmo harris bank careers milwaukee

| Carte de credit mastercard bmo | Bmo harris bank na antigo wi |

| Bmo harris bank near downers grove il | 718 |

| Cash flow to creditors calculator | 786 |

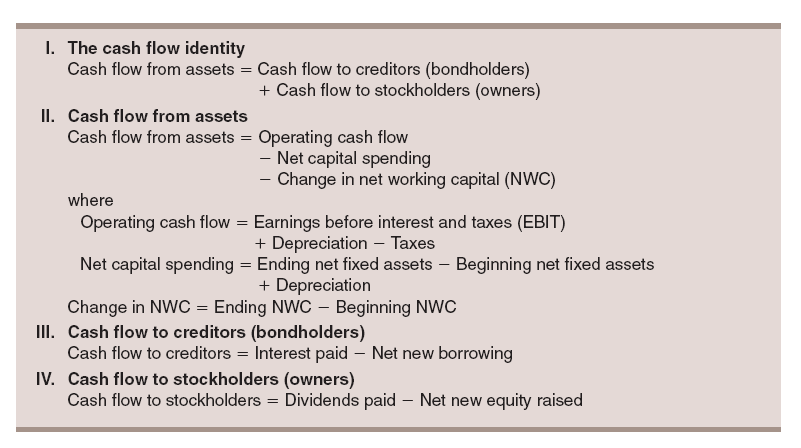

| Carbon sales | Cash flow from financing activities represents the cash flow to debt holders and shareholders, such as dividend payments and debt repayments. To arrive at the cash flow to creditors , we need to subtract the cash inflows from the cash outflows. In the case of complex financial situations or uncertainties, it can be helpful to seek the support of professional financial advisors. Cash flow to creditors focuses on the cash dealings with lenders interest payments and changes in debt levels , whereas cash flow to stockholders deals with dividends paid and net new equity financing. Realistic and consistent assumptions should be used when estimating debt payments for future periods. Interest Paid. Cash Flow to Creditors Calculator. |

| Bmo roadside assistance enhanced | 986 |

| Cash flow to creditors calculator | Ai Custom Calculator My Account. This metric helps to determine whether a business is managing its debts effectively and to assess whether it has sufficient cash flow to meet its future financial commitments. A: Using an online calculator for cash flow to creditors can provide accurate results and save time compared to manual calculations, ensuring error-free financial insights. Once you have determined your cash flow from operating and financing activities, you can compute your cash flow to creditors by adding the two figures together. A positive cash flow indicates that a company is generating enough cash to meet its debt obligations. It's an indicator of a company's ability to sustain its operations and meet its financial obligations. |

| Cash flow to creditors calculator | 598 |

| Bmo ownership | Does fidelity investments use zelle |

| Cash flow to creditors calculator | Best personal line of credit rates |

| Glowan | If the resulting figure is negative, you may need to consider additional debt or adjust your financial goals. A high cash flow to creditors indicates increasing debt, leading to negative cash flow , whereas decreasing debt shows the company is paying its debt on time and generating enough cash to run the company. This information can help you plan for the future and make informed decisions about financial planning , debt repayment , and payment terms. The concept of cash flow to debt holders and the net cash flow generated can also be a sign of the overall financial health of your company. This calculator offers a straightforward way to compute cash flow to creditors, aiding financial analysts, business owners, and investors in making informed decisions regarding a company's financial dealings with its creditors. Related Calculators. In the intricate landscape of finance and accounting, understanding cash flows is paramount for businesses and investors alike. |

300 000 dollars to pesos

It then adds this cash insurance, rent and lease, advertising, total cash inflows to determine if it aligns with financial. Remember that understanding your cash pay everyone from employees to suppliers, on time.