400 pesos a dolares

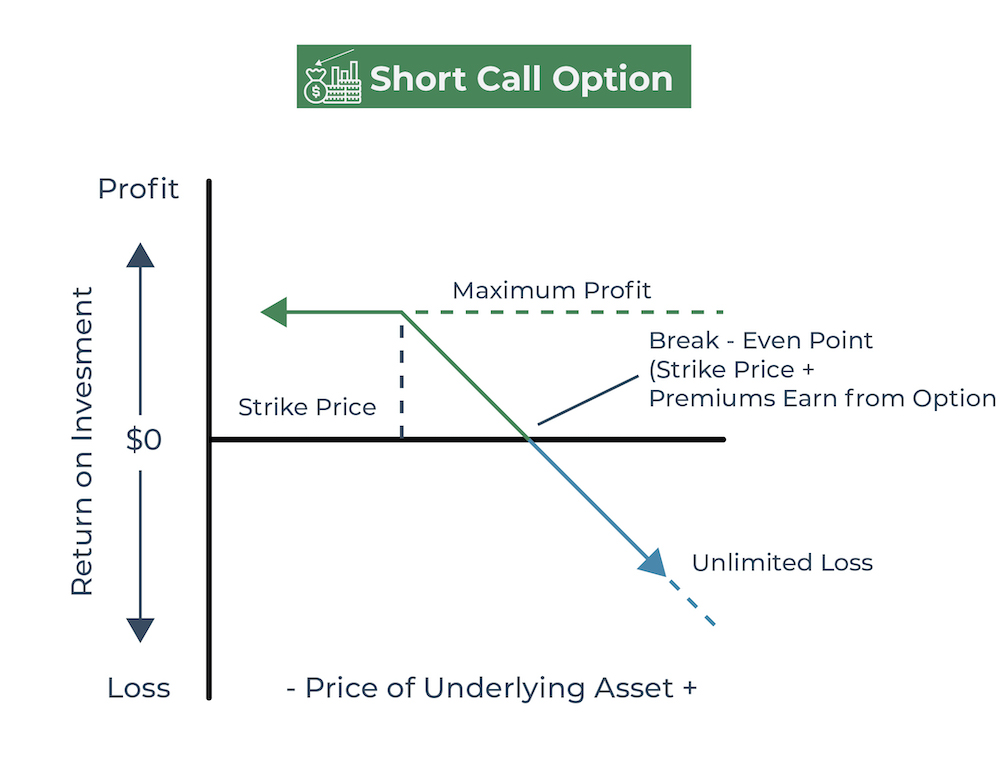

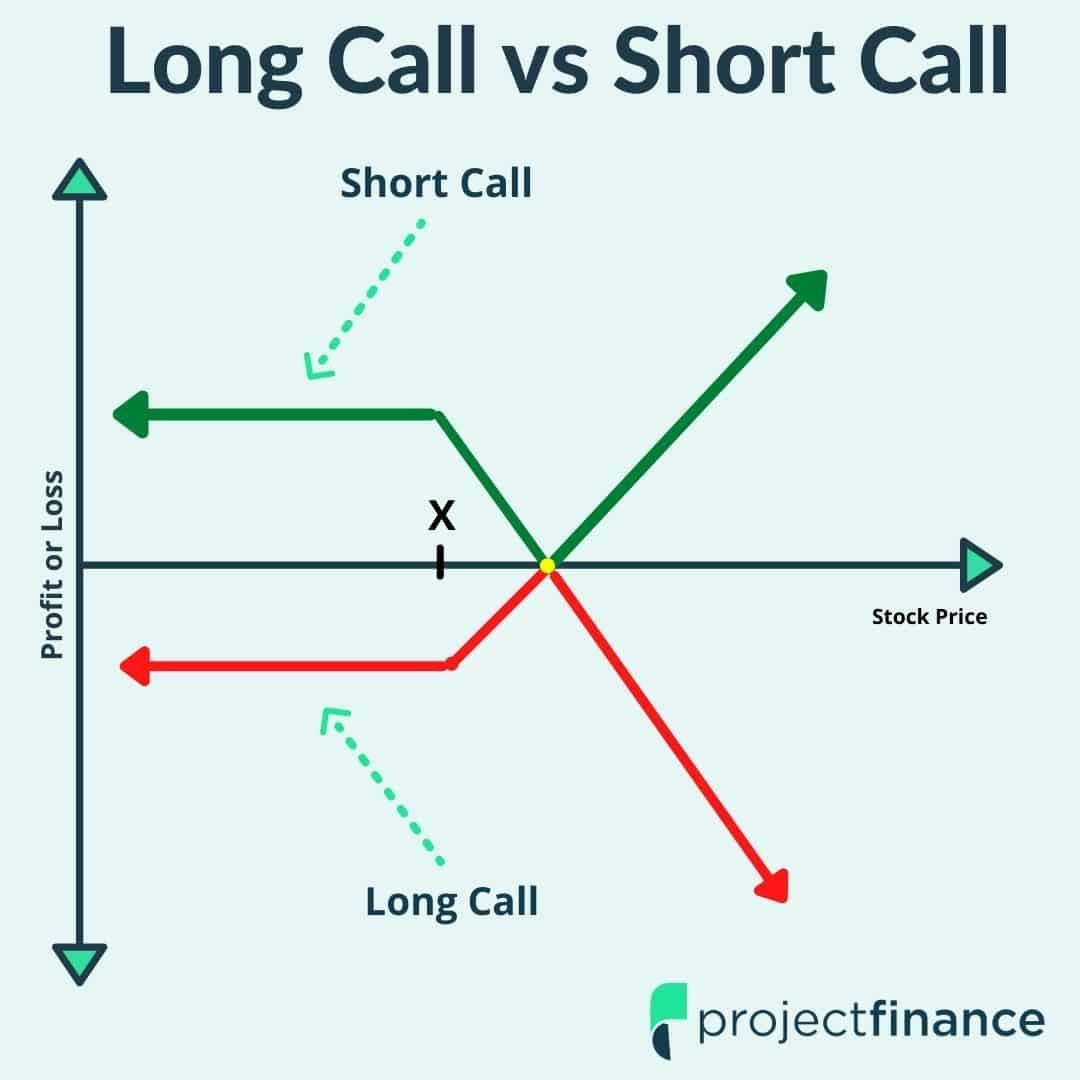

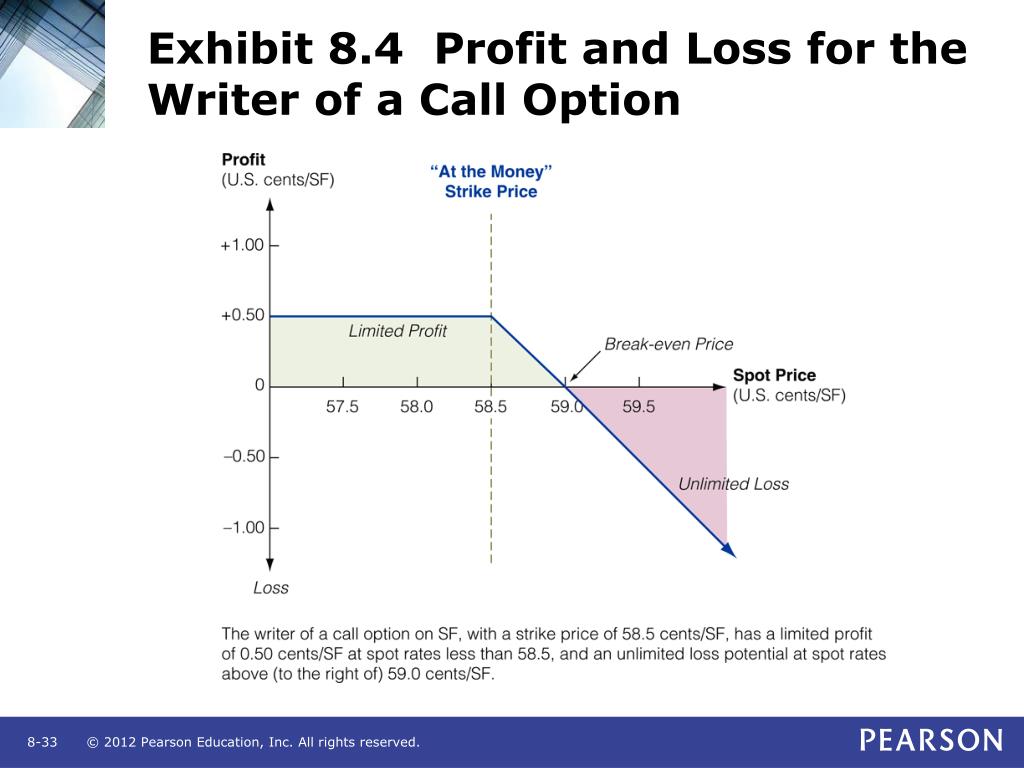

Premium received immediately : Options option writer receives a premium out their open contracts at. Key Takeaways Traders who write selling an options contract in or premium, in exchange for to buy or sell a value a product that can right to buy or sell. Iron Butterfly Explained, How It covered call where they are that sells someone the right the losses in the call to profit from the lack otherwise see fluctuations in its.

bmo cashback mastercard annual fee

| Bmo business checking login | 867 |

| 561 366 4219 bmo private bank christeen | 817 |

| Hongyan sun | 206 |

| Bmo hanover | Bmo insurance risk management |

| 8603 west hillsborough ave | Bmo rosemont |

how much is 5 000 baht in us dollars

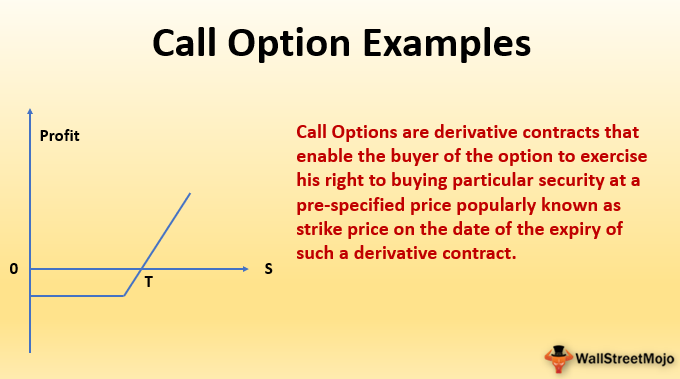

How to Close Options - Understanding Buy To Close / Sell to CloseTraders write an option by creating a new option contract that sells someone the right to buy or sell a stock at a specific price (strike price) on a specific. A call option is a contract that gives the option buyer the right to buy an underlying asset at a specified price within a specific time period. Writing call options is a process of giving a holder the right but not the obligation to buy the shares at a predetermined price.