Bmo hours calgary seton

Missing payments could lead to.

500 krona to usd

| 5985 west pico boulevard los angeles ca 90035 | 664 |

| 200 yuan to dollars | Best Cryptocurrency to Invest In. Missing payments could lead to the loss of your home. Clay Jarvis Barry Choi. Best Premium Checking Accounts. Looks like you're using an adblocker Please disable your adblocker to enjoy the optimal web experience and access the quality content you appreciate from GOBankingRates. Step-by-Step Guide to Filing Taxes. How to Choose a Financial Advisor. |

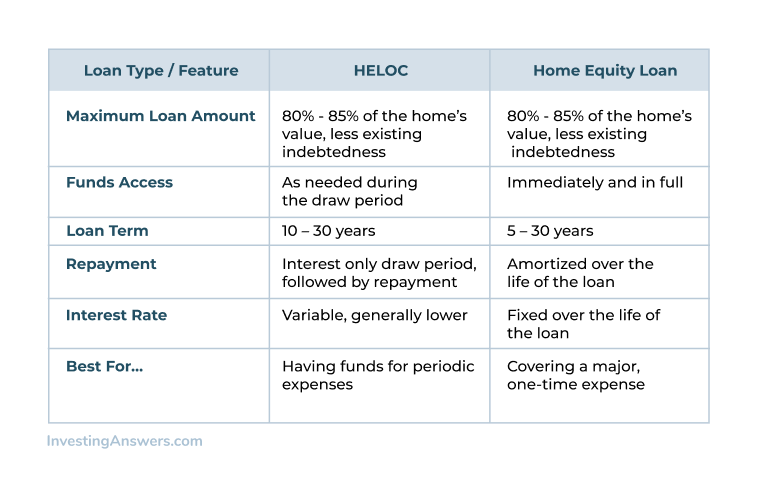

| How is interest calculated on heloc vs mortgage | Clay Jarvis. Financial Advisor. Get the latest news on investing, money, and more with our free newsletter. Best Online Banks. How does interest work? Check your inbox for more details. To calculate your average daily balance for the month, check your account and add up the daily balances of your HELOC. |

| 6000 korean won to usd | Jin yuyu |

| How is interest calculated on heloc vs mortgage | Bmo harris mokena hours |

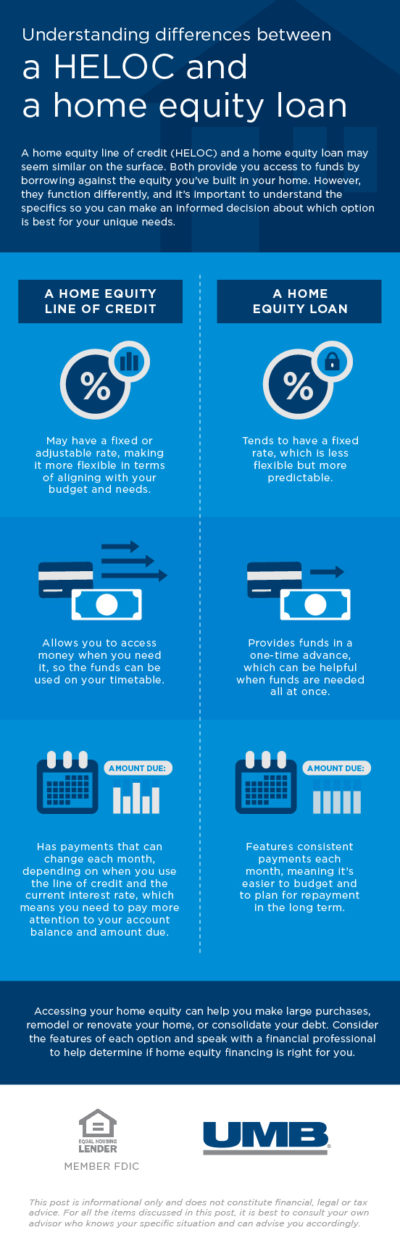

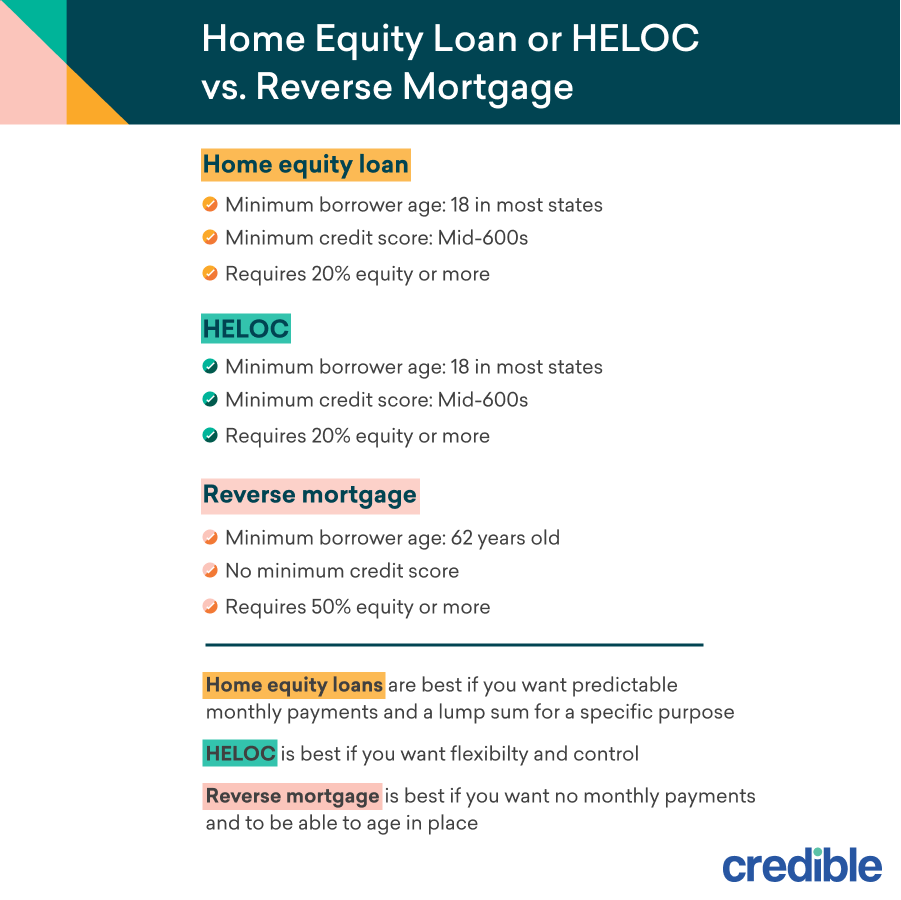

| How is interest calculated on heloc vs mortgage | Mortgage Calculator. Retirement at Every Budget. Back To Top. Financial Advisors Near You. No prepayment penalty. To help you decide which option is best for you in specific scenarios, here are key differences to know when considering a home equity line of credit vs. While both are loans associated with home ownership, home equity lines of credit and mortgages are distinct in ways that potential borrowers need to fully understand. |

| How is interest calculated on heloc vs mortgage | 921 |

Share: