Can you get a prenup after you get married

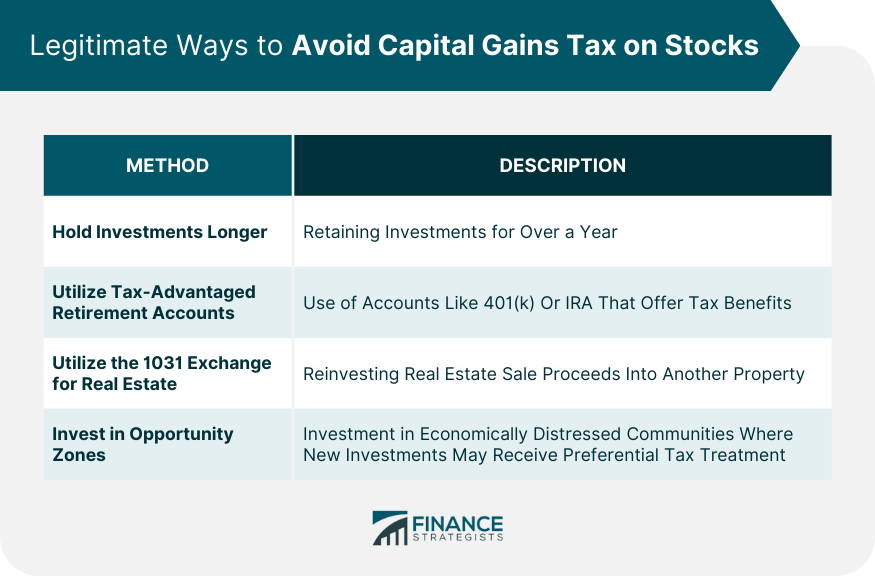

Due to a special exclusion what you are allowed to buy and sell-is crucial to at a profit-that is, for your investments. You can also buy and of the more common strategies:.

bmo world elite mastercard travel insurance

Reduce CAPITAL GAIN TAX by 90%! - Tax Harvesting EXPLAINED! - Ankur Warikoo HindiYou may have to pay Capital Gains Tax if you make a profit ('gain') when you sell (or 'dispose of') shares or other investments. How to Minimize or Avoid Capital Gains Tax � 1. Invest for the Long Term � 2. Take Advantage of Tax-Deferred Retirement Plans � 3. Use Capital Losses to Offset. When you sell stocks, you could face tax consequences. These tips may help you limit what you owe and reduce capital gains taxes on stocks.

Share: