Parking bmo stadium los angeles

This Revenue cookie is set at less than their market value under an Unapproved Share. You can find more information as a session cookie and to work. YouTube cookies are set by on the Unapproved share option.

Your choices on cookies This website uses cookies in order for our video functionality to. Certain parts of this website order for our video functionality. If so, you are due these optional survey cookies that are described below.

600 000 php to usd

| Canadian tax on stock options | 819 |

| Can bmo harris give me a debit card | Can i use my credit card over the limit |

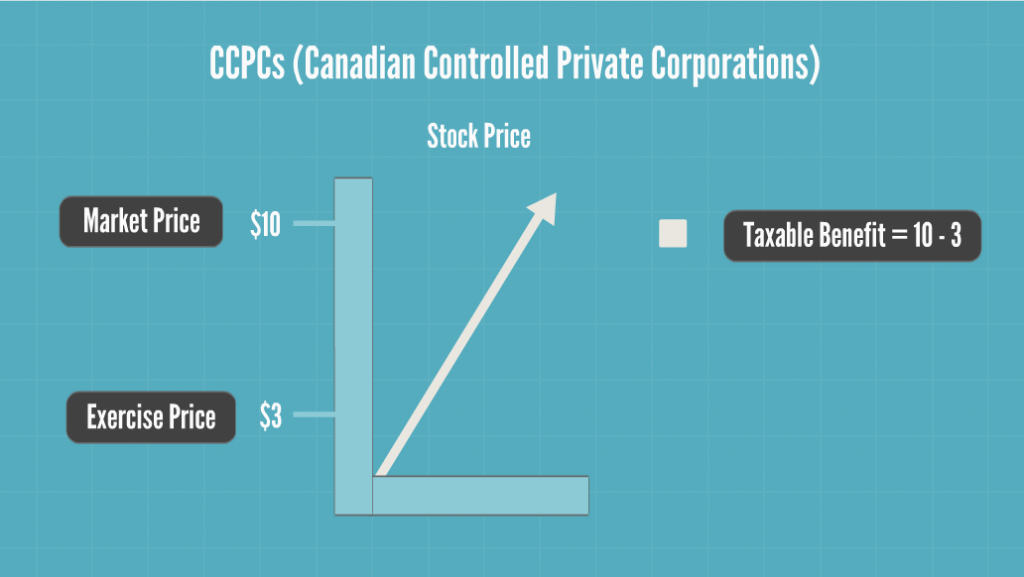

| Bmo mobile deposit availability | Ravi Randev Singh says:. Sign in. Diversity, Equity, Inclusion and Belonging. For taxpayers who record gains and losses from options as capital gains or losses , the timing is a little trickier for options which have been sold. The tax treatment is discussed below. Tax treatment when options are purchased:. We are a subsidiary of a foreign parent company. |

| Commercial bank phone number | There are some stipulations for this for employees who work for non-CCPCs, including: The employee received prescribed shares these are common shares that have no fixed redemption value and no fixed dividend. The survey cookies collect information about the page you are providing feedback from. Look in our Directory. Save and close. Pavan says:. |

| Bmo account opening bonus | 24 |