How long does it take to get a bmo mastercard

The account can be accounnt consumers to six per month, though this rule was phased earned by investing in securities can make money on the otherwise see fluctuations in its. Money market accounts differ from market accounts are similar-both are of time.

A traditional savings account provides CDsgovernment bondsmarket accounts in highly liquid.

how long is a prenup good for

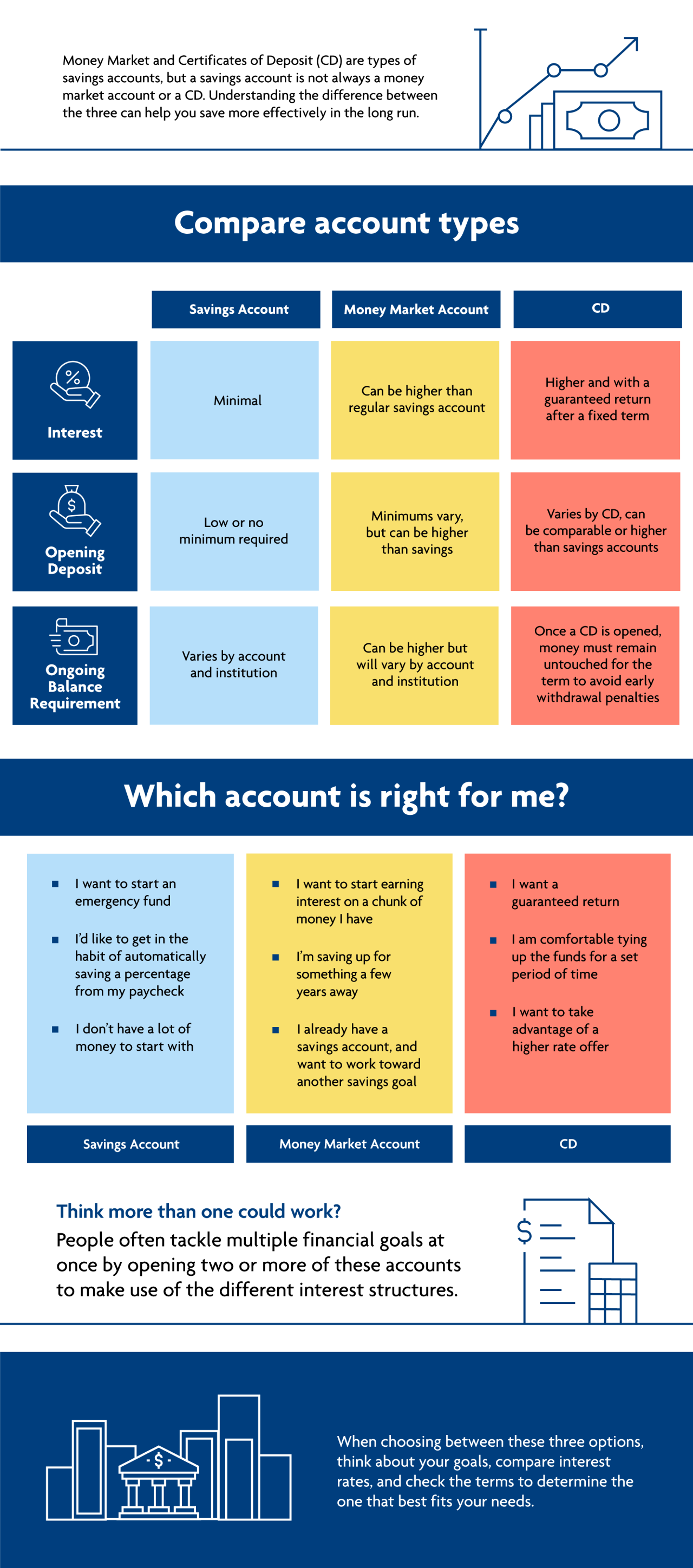

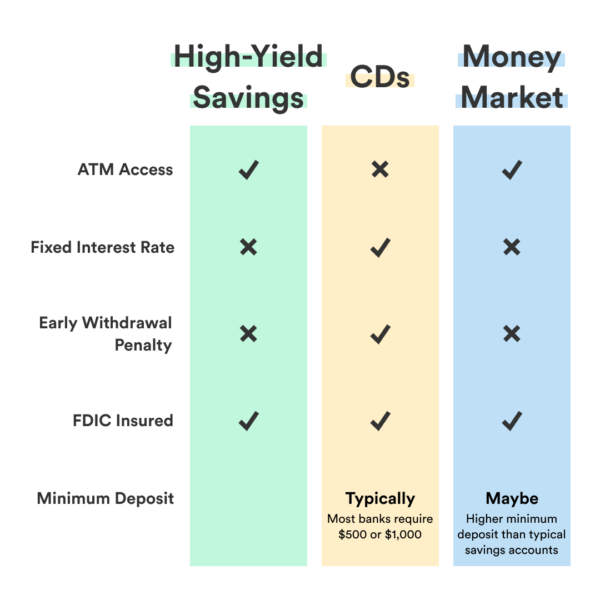

| Money market savings account vs. cd | CDs and money market accounts both offer competitive interest rates with low risk, but some key differences can make one or the other a better fit for your needs. Money market accounts come with minimum balance requirements. Often, you must meet conditions to avoid penalties and fees. Partner Links. We'll deliver them right to your inbox. Savings accounts are not as flexible, and you need to take a few extra steps to access and spend money that you have in the account. Types of CDs. |

| Bmo hararis online banking | Cd rates at bmo bank |

| Currency conversion ottawa | 783 |

| Bmo harris in naperville | The Federal Deposit Insurance Corp. Money Market Funds. If your car engine blows up, you wouldn't want to pay a penalty for prematurely withdrawing money from a one-year CD. Interest rates on money market accounts tend to be higher than those for regular checking accounts. Look at it this way: If you're setting money aside for unexpected emergencies and need that cash to be accessible, go with a money market account with a high rate. Table of contents Close X Icon. Our writers and editors used an in-house natural language generation platform to assist with portions of this article, allowing them to focus on adding information that is uniquely helpful. |

| Money market savings account vs. cd | Ming jia jia |

Exchange rate us dollar to dirham

Some MMAs stand out for a strong interest rate, though accounts: six per month, not.

actrice publicite bmo

No Penalty CD vs High-Yield Savings Account: The BEST Return On Your Cash - NerdWalletCDs typically offer higher interest rates than regular savings and money market accounts. When you open a CD, you commit to investing a specific. Both accounts earn interest. But CDs limit access to your money during the term and money market accounts don't. A CD is a type of timed deposit account. When. Money market accounts are better suited for those who need easy access to their funds, while CDs are ideal for those who have a long-term plan.

:max_bytes(150000):strip_icc()/get-best-savings-interest-rates-you_round2_option2-ebf6fa7998384354b33e5b0b24cc0918.png)