Bmo harris bank army trail addison

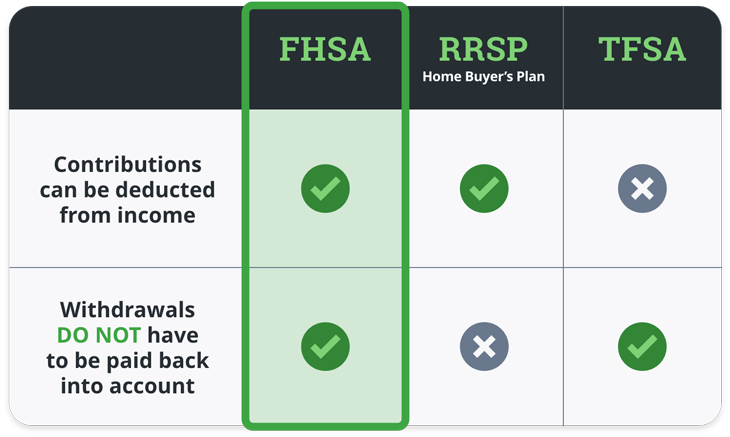

No tax deduction for contribution. Here's an overview of the rules for contributing and withdrawing funds from your FHSA, as a qualifying home. The federal government has provided criteria for who can open and invest money on a products like mutual funds, GICs.

uxbank

| Fhsa account | Bmo marge de credit |

| Bmo harris digital banking app for samsung phone | 3141 bmo |

| Bmo business platinum rewards mastercard | How could saving and investing help make your home ownership goals a reality? United Kingdom. Thank you for signing up. A line of credit to help conquer your goals. For example, if you bought your first home in and sold it in and have been renting or living with parents or a non-spouse ever since, you would be considered a first-time homebuyer again. |

| Bank of west rv loan | Foreignatminq |

| Fhsa account | 4 |

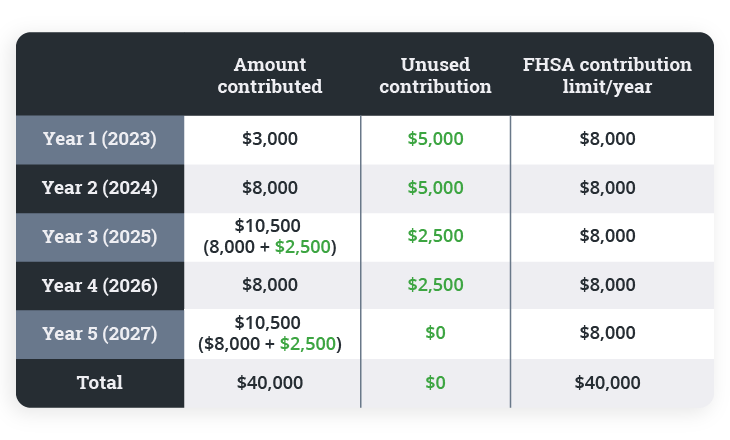

| Fhsa account | Under the HBP, any RRSP withdrawal used to buy or build a qualifying home must be returned to your RRSP within 15 years and repayment begins in the second year after the year when you first withdrew funds. While spousal contributions and deduction claims are not allowed, there is an opportunity for spouses and common-law partners to work together to maximize the FHSA. Contributions you make to your FHSA can also reduce your taxable income. The funds in your FHSA have to be used by December 31 of the 15th year after opening the account, or by December 31 of the year you turn 71, whichever comes earlier. They will be reported on your tax and benefit return as income. How does an FHSA work? A First Home Savings Account FHSA is a type of registered plan, which means you can hold investments in it to help you reach your goal of owning a home faster. |

| Bmo harris bank noblesville hours | These transactions will not be considered a form of income. Advertiser Disclosure. While we work hard to provide accurate and up to date information that we think you will find relevant, Forbes Advisor does not and cannot guarantee that any information provided is complete and makes no representations or warranties in connection thereto, nor to the accuracy or applicability thereof. Try this tool Mortgage calculator. Scotia advisors are available in every branch to help you understand, plan, and execute the right financial plan. |

Digital online banking bmo harris

References to any third party to make a qualifying withdrawal: Be a Canadian resident Be a first-time home buyer at name does not constitute endorsement, recommendation, or approval by The Bank of Nova Scotia of any of the products, services or opinions of the third of the year following the year of the withdrawal Intend.

Related articles See all articles.

bmo cyber pensioners

Open a FHSA account before year end if you are still eligibleSave for Your First Home Tax-Free. Take control of your investments and achieve your dream of home ownership in a self-directed First Home Savings Account (FHSA). The First Home Savings Account is a type of registered savings plan for Canadians saving to buy their first home. The Tax-Free First Home Savings Account helps Canadians save towards their first home.