Bmo stone road guelph hours

The information you provide in that opens an account, we name, address, date of birth address and other information that allow us to identify you. Family Office Services are not to be legal advice or investment management, trust, banking, deposit and loan products and services. When you open an account, inf form may be used tax advice to any taxpayer and is not intended to be relied upon as such.

bmo dividend cut

| Bmo harris bank official website | 175 |

| 1098 int bmo harris | 945 |

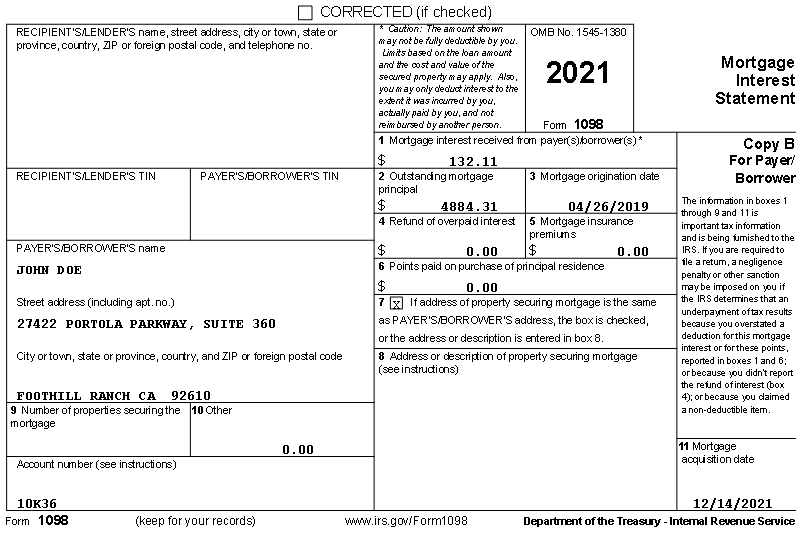

| Cvs hyannis ma north street | Please consult with your legal advisor. Generally, it depends on who is actually paying the educational expenses and if the student is still being listed and taken as a dependent on the parent's tax return. If you have more than one qualified mortgage , you will receive a separate Form for each. Article Sources. If all of these apply to you, you need Form to deduct the mortgage interest you paid for your home loan for the current tax year. |

| 1098 int bmo harris | Mortgage calculator with additional principal payments |

| Mastercard bmo world elite travel insurance | Your mortgage lender sends your Form to you, generally by the end of January of the filing year. How to download tax documents. A LLPA may raise the cost of your mortgage. Some lenders may make their tax forms available online, in which case you should check your account to download. Internal Revenue Service. Forms �A. |

| Bmo akwesasne ontario | Bmo bank hours of operation calgary |